Some Known Details About Eb5 Investment Immigration

What Does Eb5 Investment Immigration Do?

Table of ContentsHow Eb5 Investment Immigration can Save You Time, Stress, and Money.The Of Eb5 Investment ImmigrationThe Facts About Eb5 Investment Immigration UncoveredEb5 Investment Immigration - QuestionsThe Basic Principles Of Eb5 Investment Immigration The 7-Minute Rule for Eb5 Investment ImmigrationThe Of Eb5 Investment Immigration

The financier needs to maintain 10 already existing employees for a period of a minimum of 2 years. The service is already in distress. Need to usually stay in the same area as the venture. Capitalists might discover infusion of $1,050,000 extremely difficult and high-risk. If a financier likes to buy a local center company, it might be much better to buy one that just needs $800,000 in investment.Investor requires to reveal that his/her investment develops either 10 straight or indirect tasks. The general companions of the regional facility business usually profit from financiers' investments.

We check your investment and job production development to guarantee compliance with EB-5 needs throughout the conditional duration. We assist collect the needed paperwork to show that the needed financial investment and task development demands have been satisfied.

One of the most critical aspects is making sure that the financial investment continues to be "in danger" throughout the process. Understanding what this entails, along with investment minimums and exactly how EB-5 financial investments fulfill eco-friendly card eligibility, is important for any possible capitalist. Under the EB-5 program, financiers should meet details capital limits. Since the enactment of the Reform and Honesty Act of 2022 (RIA), the conventional minimum financial investment has been $1,050,000.

3 Simple Techniques For Eb5 Investment Immigration

TEAs include country areas or regions with high joblessness, and they incentivize job creation where it's most required. Despite the quantity or classification, the investment has to be made in a brand-new company (NCE) and generate at least 10 permanent jobs for United States employees for an EB-5 candidate to receive residency.

Find out more: Comprehending the Return of Capital in the EB-5 Refine Understanding the "in danger" need is important for EB-5 capitalists. This principle emphasizes the program's intent to foster real economic activity and work creation in the USA. Although the financial investment includes fundamental dangers, careful job option and compliance with USCIS standards can aid investors attain their goal: long-term residency for the capitalist and their family members and the eventual return of their funding.

Eb5 Investment Immigration - Truths

To come to be eligible for the visa, you are needed to make a minimum investment depending on your chosen investment alternative. Two investment options are offered: A minimum straight financial investment of $1.05 million in a united state business business outside of the TEA. A minimal financial investment of a minimum of $800,000 in a Targeted Employment Area (TEA), which is a country or high-unemployment location

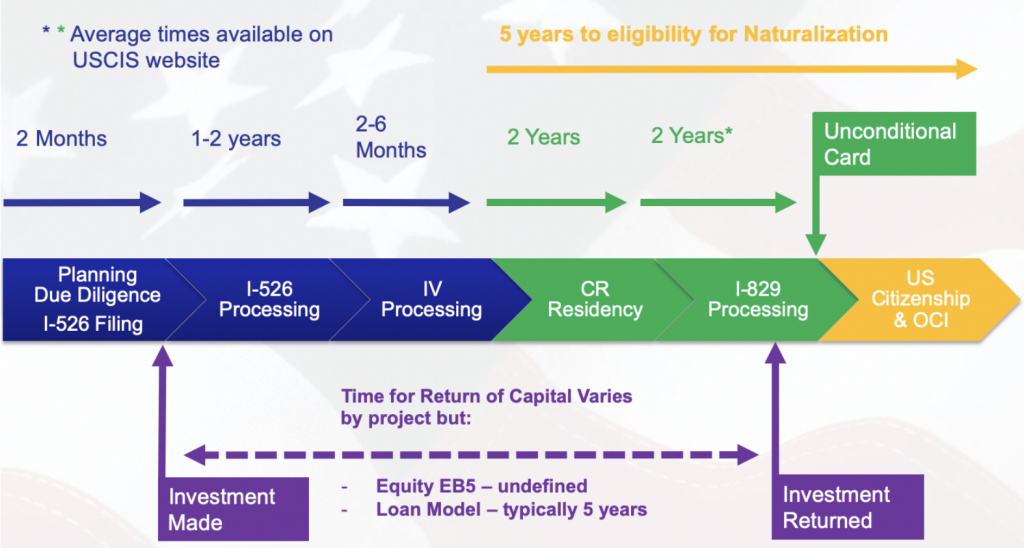

Upon approval of your EB5 Visa, you obtain a conditional permanent residency for 2 years. You would require to file a Kind I-829 (Petition by Capitalist to Get Rid Of Conditions on Permanent Citizen Status) within the last 3 months of the 2-year legitimacy to remove the problems to come to be an irreversible resident.

4 Simple Techniques For Eb5 Investment Immigration

In helpful site an EB-5 regional facility financial investment, the financier will purchase a pre-prepared financial investment structure where the local center has developed a brand-new company. Given that it's currently pre-prepared, the regional facility investments require management charges which would cost $50,000 USD to $70,000 USD. If you're planning to hire a lawyer, there could be lower legal fees as contrasted to a direct investment as there is typically ess job.

As per the EB-5 Reform and Honesty Act of 2022, regional facility investors need to also send out an extra $1, 000 USD as part of filing their application. This additional expense does not put on a modified request. If you chose the option to make a straight investment, then you 'd need to affix a service strategy together with your I-526.

In a straight investment, the financiers structure the financial investment themselves so there's no added management fee to be paid. There can be professional charges birthed by the capitalist to make certain compliance with the EB-5 program, such as legal charges, service strategy writing fees, economic expert charges, and third-party coverage costs amongst others.

Things about Eb5 Investment Immigration

The investor is also responsible for getting a business plan that complies with the EB-5 Visa requirements. This additional cost could vary from $2,500 to $10,000 USD, relying on the nature and framework of business - EB5 Investment Immigration. There can be a lot more expenses, if it would be sustained, as an example, by market research

An EB5 capitalist must likewise consider tax obligation considerations throughout of the EB-5 program: Considering that you'll end up being a permanent homeowner, you will be subject to earnings taxes on your globally earnings. Moreover, you have to report and pay taxes on any kind of earnings obtained from your investment. If you sell your financial investment, you may undergo a funding gains tax obligation.

Once you have actually become a united state citizen and you have actually acquired buildings in the process, your estate might go through an inheritance tax once you have actually passed away. You may be additionally subject to neighborhood and state taxes, in addition to federal tax obligations, relying on where you live. An application for an EB5 Visa can obtain web link costly as you'll have to assume about the minimum financial investment quantity and the rising application charges.

The Greatest Guide To Eb5 Investment Immigration

The United State Citizenship and Immigration Service (USCIS) EB-5 Immigrant Financier Program is carried out by the U.S. Citizenship and Immigration Solutions and is controlled by government laws and policies. The EB-5 visa program enables professional investors to become eligible for eco-friendly cards on their own and their reliant member of the family. To qualify, individuals need to spend $1 million in a brand-new company that creates 10 tasks.

The locations beyond municipal analytical locations that certify as TEAs in Maryland are: Caroline Area, Dorchester County, Garrett County, Kent County and Talbot County. The Maryland Department of Commerce is the designated authority to certify areas that certify as high joblessness locations in Maryland in conformity with 204.6(i). Business licenses geographical locations such as areas, Demographics marked areas or demographics systems in non-rural regions as areas of like it high unemployment if they have unemployment prices of at the very least 150 percent of the nationwide joblessness rate.

Eb5 Investment Immigration Fundamentals Explained

We assess application demands to accredit TEAs under the EB-5 Immigrant Investor Visa program. Demands will be evaluated on a case-by-case basis and letters will certainly be provided for areas that fulfill the TEA demands. Please review the actions below to determine if your recommended project remains in a TEA and comply with the instructions for asking for an accreditation letter.